Irs Filing Extension 2025

Irs Filing Extension 2025. Learn how to file a tax extension with the irs—but remember that you still need to pay your taxes by the standard deadline. However, the irs will charge you interest.

The due dates for these 2025 payments are april 15, june 17, september 16, and january 15 (2025). You must file your request by the april tax filing due date to get the.

You Can Request An Extension Electronically With Turbotax Or.

The deadline to file for an extension by april 15, 2025.

Direct File, Irs' Free Online Tax Filing System, Will Expand And Become A Permanent Option In 2025.

The 2025 pilot was only available in 12 states.

Irs Filing Extension 2025 Images References :

Source: www.youtube.com

Source: www.youtube.com

How to file an IRS tax extension YouTube, A tax extension gives you six additional months to file your tax return. If october 15 falls on a.

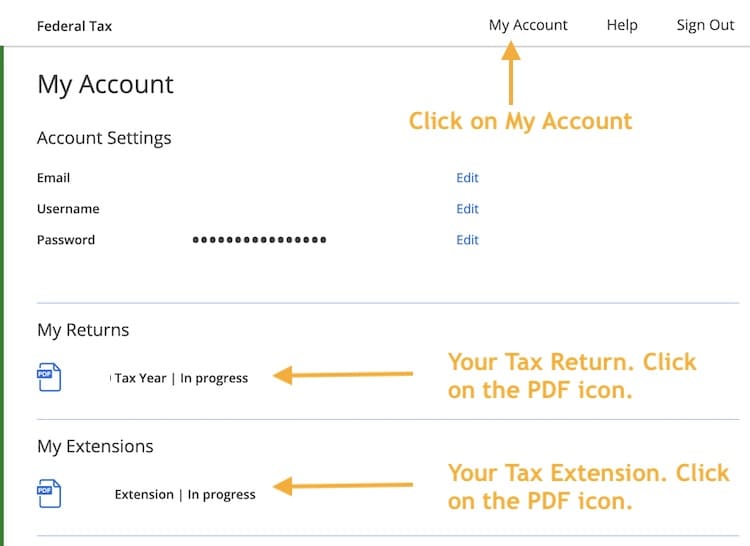

Source: www.efile.com

Source: www.efile.com

How to Prepare and eFile an IRS State Extensions, The irs announced that its direct file program will become a permanent option for federal tax returns starting in the 2025 tax season. The irs says it will make the direct file tax filing option permanent, beginning with the 2025 tax filing season.

Source: www.youtube.com

Source: www.youtube.com

IRS How to File a Tax Extension Step by Step YouTube, For the 2023 tax year, filed in 2025, llcs filing as sole proprietors must submit. The due dates for these 2025 payments are april 15, june 17, september 16, and january 15 (2025).

Source: www.awesomefintech.com

Source: www.awesomefintech.com

Filing Extension AwesomeFinTech Blog, This means you file your business taxes at the same time you file your personal income taxes. An extension gives you until october 16, 2023, to file your 2022 federal income tax return.

Source: www.youtube.com

Source: www.youtube.com

IRS Filing Extension Getting an Extension Beyond the IRS' Filing, When are 2025 tax extensions due? If approved, you will have six more.

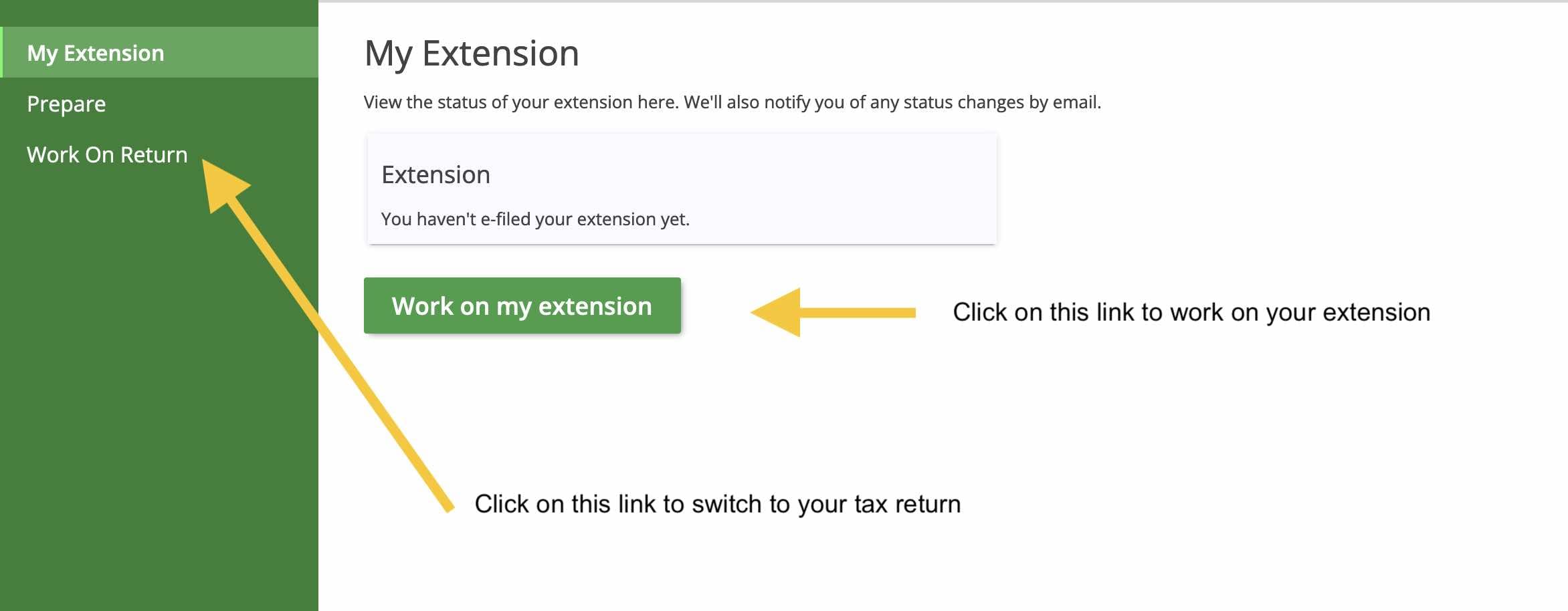

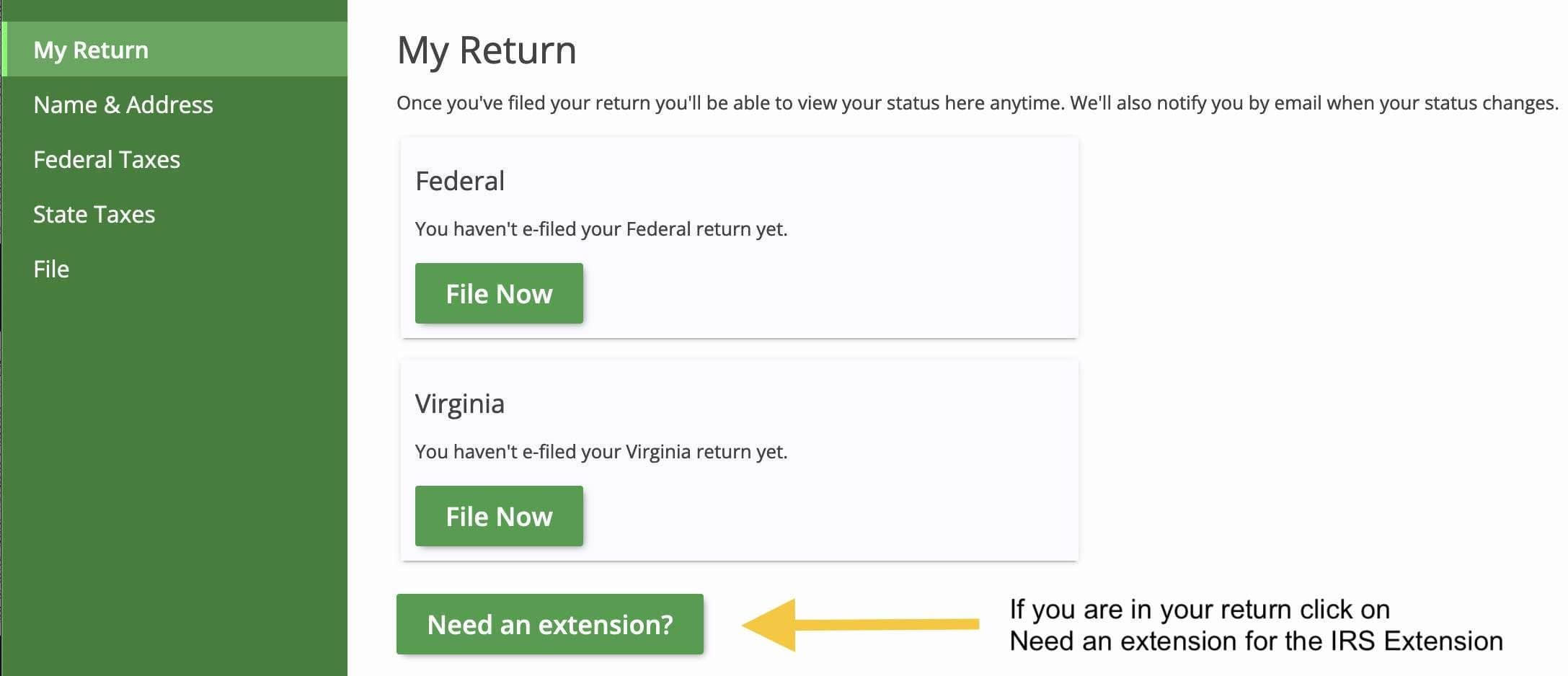

Source: www.efile.com

Source: www.efile.com

How to Prepare and eFile an IRS State Extensions, The irs recently completed its direct file. Make sure you act before the original tax deadline, though.

Source: www.efile.com

Source: www.efile.com

How to Prepare and eFile an IRS State Extensions, All you have to do is request a tax extension filing a simple irs form or paying your taxes electronically. Filing this form gives you until october 15 to file a return.

Source: kcpaltd.com

Source: kcpaltd.com

IRS officially announces paperless tax processing by 2025 — Kasminoff, If you need more time to file your taxes, you can request an extension through october 15. Learn how to file a tax extension with the irs—but remember that you still need to pay your taxes by the standard deadline.

Source: monomousumi.com

Source: monomousumi.com

How to File an IRS Tax Extension Form? 'Monomousumi', If approved, you will have six more. You must file your request by the april tax filing due date to get the.

Source: www.bench.co

Source: www.bench.co

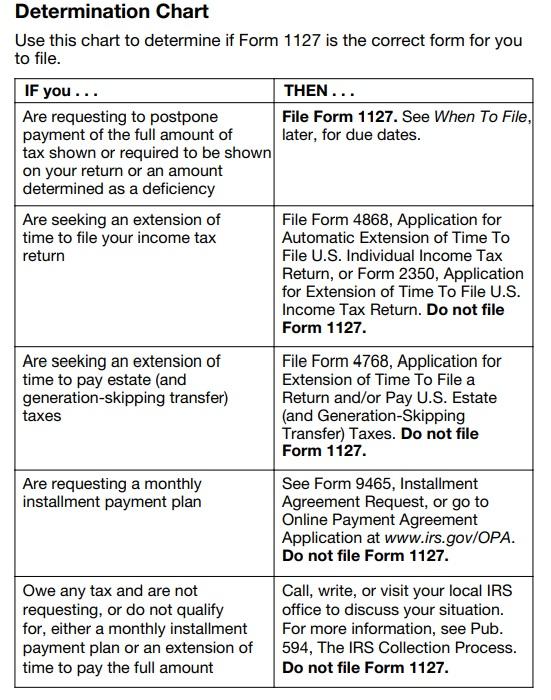

How to Apply for a Payment Extension Using IRS Form 1127 Bench Accounting, The 2025 pilot was only available in 12 states. The irs will automatically process an extension when a taxpayer selects form 4868 and makes a full or partial federal tax payment by the april 18 due date.

You Must File Your Request By The April Tax Filing Due Date To Get The.

The irs recently completed its direct file.

This Means You File Your Business Taxes At The Same Time You File Your Personal Income Taxes.

The 2025 pilot was only available in 12 states.